Uniswap-v2 Contract Walk-Through

Introduction

Uniswap v2 can create an exchange market between any two ERC-20 tokens. In this article we will go over the source code for the contracts that implement this protocol and see why they are written this way.

What Does Uniswap Do?

Basically, there are two types of users: liquidity providers and traders.

The liquidity providers provide the pool with the two tokens that can be exchanged (we'll call them Token0 and Token1). In return, they receive a third token that represents partial ownership of the pool called a liquidity token.

Traders send one type of token to the pool and receive the other (for example, send Token0 and receive Token1) out of the pool provided by the liquidity providers. The exchange rate is determined by the relative number of Token0s and Token1s that the pool has. In addition, the pool takes a small percent as a reward for the liquidity pool.

When liquidity providers want their assets back they can burn the pool tokens and receive back their tokens, including their share of the rewards.

Click here for a fuller description.

Why v2? Why not v3?

Uniswap v3 is an upgrade that is much more complicated than the v2. It is easier to first learn v2 and then go to v3.

Core Contracts vs Periphery Contracts

Uniswap v2 is divided into two components, a core and a periphery. This division allows the core contracts, which hold the assets and therefore have to be secure, to be simpler and easier to audit. All the extra functionality required by traders can then be provided by periphery contracts.

Data and Control Flows

This is the flow of data and control that happens when you perform the three main actions of Uniswap:

- Swap between different tokens

- Add liquidity to the market and get rewarded with pair exchange ERC-20 liquidity tokens

- Burn ERC-20 liquidity tokens and get back the ERC-20 tokens that the pair exchange allows traders to exchange

Swap

This is most common flow, used by traders:

Caller

- Provide the periphery account with an allowance in the amount to be swapped.

- Call one of the periphery contract's many swap functions (which one depends on whether ETH is involved or not, whether the trader specifies the amount of tokens to deposit or the amount of tokens to get back, etc).

Every swap function accepts a

path, an array of exchanges to go through.

In the periphery contract (UniswapV2Router02.sol)

- Identify the amounts that need to be traded on each exchange along the path.

- Iterates over the path. For every exchange along the way it sends the input token and then calls the exchange's

swapfunction. In most cases the destination address for the tokens is the next pair exchange in the path. In the final exchange it is the address provided by the trader.

In the core contract (UniswapV2Pair.sol)

- Verify that the core contract is not being cheated and can maintain sufficient liquidity after the swap.

- See how many extra tokens we have in addition to the known reserves. That amount is the number of input tokens we received to exchange.

- Send the output tokens to the destination.

- Call

_updateto update the reserve amounts

Back in the periphery contract (UniswapV2Router02.sol)

- Perform any necessary cleanup (for example, burn WETH tokens to get back ETH to send the trader)

Add Liquidity

Caller

- Provide the periphery account with an allowance in the amounts to be added to the liquidity pool.

- Call one of the periphery contract's

addLiquidityfunctions.

In the periphery contract (UniswapV2Router02.sol)

- Create a new pair exchange if necessary

- If there is an existing pair exchange, calculate the amount of tokens to add. This is supposed to be identical value for both tokens, so the same ratio of new tokens to existing tokens.

- Check if the amounts are acceptable (callers can specify a minimum amount below which they'd rather not add liquidity)

- Call the core contract.

In the core contract (UniswapV2Pair.sol)

- Mint liquidity tokens and send them to the caller

- Call

_updateto update the reserve amounts

Remove Liquidity

Caller

- Provide the periphery account with an allowance of liquidity tokens to be burned in exchange for the underlying tokens.

- Call one of the periphery contract's

removeLiquidityfunctions.

In the periphery contract (UniswapV2Router02.sol)

- Send the liquidity tokens to the pair exchange

In the core contract (UniswapV2Pair.sol)

- Send the destination address the underlying tokens in proportion to the burned tokens. For example if there are 1000 A tokens in the pool, 500 B tokens, and 90 liquidity tokens, and we receive 9 tokens to burn, we're burning 10% of the liquidity tokens so we send back the user 100 A tokens and 50 B tokens.

- Burn the liquidity tokens

- Call

_updateto update the reserve amounts

The Core Contracts

These are the secure contracts which hold the liquidity.

UniswapV2Pair.sol

This contract implements the actual pool that exchanges tokens. It is the core Uniswap functionality.

1pragma solidity =0.5.16;23import './interfaces/IUniswapV2Pair.sol';4import './UniswapV2ERC20.sol';5import './libraries/Math.sol';6import './libraries/UQ112x112.sol';7import './interfaces/IERC20.sol';8import './interfaces/IUniswapV2Factory.sol';9import './interfaces/IUniswapV2Callee.sol';Prikaži vseThese are all the interfaces that the contract needs to know about, either because the contract implements them (IUniswapV2Pair and UniswapV2ERC20) or because it calls contracts that implement them.

1contract UniswapV2Pair is IUniswapV2Pair, UniswapV2ERC20 {This contract inherits from UniswapV2ERC20, which provides the ERC-20 functions for the liquidity tokens.

1 using SafeMath for uint;The SafeMath library is used to avoid overflows and underflows. This is important because otherwise we might end up with a situation where a value should be -1, but is instead 2^256-1.

1 using UQ112x112 for uint224;A lot of calculations in the pool contract require fractions. However, fractions are not supported by the EVM.

The solution that Uniswap found is to use 224 bit values, with 112 bits for the integer part, and 112 bits for the fraction. So 1.0 is represented as 2^112, 1.5 is represented as 2^112 + 2^111, etc.

More details about this library are available later in the document.

Variables

1 uint public constant MINIMUM_LIQUIDITY = 10**3;To avoid cases of division by zero, there is a minimum number of liquidity tokens that always exist (but are owned by account zero). That number is MINIMUM_LIQUIDITY, a thousand.

1 bytes4 private constant SELECTOR = bytes4(keccak256(bytes('transfer(address,uint256)')));This is the ABI selector for the ERC-20 transfer function. It is used to transfer ERC-20 tokens in the two token accounts.

1 address public factory;This is the factory contract that created this pool. Every pool is an exchange between two ERC-20 tokens, the factory is a central point that connects all of these pools.

1 address public token0;2 address public token1;There are the addresses of the contracts for the two types of ERC-20 tokens that can be exchanged by this pool.

1 uint112 private reserve0; // uses single storage slot, accessible via getReserves2 uint112 private reserve1; // uses single storage slot, accessible via getReservesThe reserves the pool has for each token type. We assume that the two represent the same amount of value, and therefore each token0 is worth reserve1/reserve0 token1's.

1 uint32 private blockTimestampLast; // uses single storage slot, accessible via getReservesThe timestamp for the last block in which an exchange occurred, used to track exchange rates across time.

One of the biggest gas expenses of Ethereum contracts is storage, which persists from one call of the contract to the next. Each storage cell is 256 bits long. So three variables, reserve0, reserve1, and blockTimestampLast, are allocated in such a way a single storage value can include all three of them (112+112+32=256).

1 uint public price0CumulativeLast;2 uint public price1CumulativeLast;These variables hold the cumulative costs for each token (each in term of the other). They can be used to calculate the average exchange rate over a period of time.

1 uint public kLast; // reserve0 * reserve1, as of immediately after the most recent liquidity eventThe way the pair exchange decides on the exchange rate between token0 and token1 is to keep the multiple of the two reserves constant during trades. kLast is this value. It changes when a liquidity provider deposits or withdraws tokens, and it increases slightly because of the 0.3% market fee.

Here is a simple example. Note that for the sake of simplicity the table only has three digits after the decimal point, and we ignore the 0.3% trading fee so the numbers are not accurate.

| Event | reserve0 | reserve1 | reserve0 * reserve1 | Average exchange rate (token1 / token0) |

|---|---|---|---|---|

| Initial setup | 1,000.000 | 1,000.000 | 1,000,000 | |

| Trader A swaps 50 token0 for 47.619 token1 | 1,050.000 | 952.381 | 1,000,000 | 0.952 |

| Trader B swaps 10 token0 for 8.984 token1 | 1,060.000 | 943.396 | 1,000,000 | 0.898 |

| Trader C swaps 40 token0 for 34.305 token1 | 1,100.000 | 909.090 | 1,000,000 | 0.858 |

| Trader D swaps 100 token1 for 109.01 token0 | 990.990 | 1,009.090 | 1,000,000 | 0.917 |

| Trader E swaps 10 token0 for 10.079 token1 | 1,000.990 | 999.010 | 1,000,000 | 1.008 |

As traders provide more of token0, the relative value of token1 increases, and vice versa, based on supply and demand.

Lock

1 uint private unlocked = 1;There is a class of security vulnerabilities that are based on reentrancy abuse. Uniswap needs to transfer arbitrary ERC-20 tokens, which means calling ERC-20 contracts that may attempt to abuse the Uniswap market that calls them.

By having an unlocked variable as part of the contract, we can prevent functions from being called while they are running (within the same transaction).

1 modifier lock() {This function is a modifier, a function that wraps around a normal function to change its behavior is some way.

1 require(unlocked == 1, 'UniswapV2: LOCKED');2 unlocked = 0;If unlocked is equal to one, set it to zero. If it is already zero revert the call, make it fail.

1 _;In a modifier _; is the original function call (with all the parameters). Here it means that the function call only happens if unlocked was one when it was called, and while it is running the value of unlocked is zero.

1 unlocked = 1;2 }After the main function returns, release the lock.

Misc. functions

1 function getReserves() public view returns (uint112 _reserve0, uint112 _reserve1, uint32 _blockTimestampLast) {2 _reserve0 = reserve0;3 _reserve1 = reserve1;4 _blockTimestampLast = blockTimestampLast;5 }This function provides callers with the current state of the exchange. Notice that Solidity functions can return multiple values.

1 function _safeTransfer(address token, address to, uint value) private {2 (bool success, bytes memory data) = token.call(abi.encodeWithSelector(SELECTOR, to, value));This internal function transfers an amount of ERC20 tokens from the exchange to somebody else. SELECTOR specifies that the function we are calling is transfer(address,uint) (see definition above).

To avoid having to import an interface for the token function, we "manually" create the call using one of the ABI functions.

1 require(success && (data.length == 0 || abi.decode(data, (bool))), 'UniswapV2: TRANSFER_FAILED');2 }There are two ways in which an ERC-20 transfer call can report failure:

- Revert. If a call to an external contract reverts, then the boolean return value is

false - End normally but report a failure. In that case the return value buffer has a non-zero length, and when decoded as a boolean value it is

false

If either of these conditions happen, revert.

Events

1 event Mint(address indexed sender, uint amount0, uint amount1);2 event Burn(address indexed sender, uint amount0, uint amount1, address indexed to);These two events are emitted when a liquidity provider either deposits liquidity (Mint) or withdraws it (Burn). In either case, the amounts of token0 and token1 that are deposited or withdrawn are part of the event, as well as the identity of the account that called us (sender). In the case of a withdrawal, the event also includes the target that received the tokens (to), which may not be the same as the sender.

1 event Swap(2 address indexed sender,3 uint amount0In,4 uint amount1In,5 uint amount0Out,6 uint amount1Out,7 address indexed to8 );This event is emitted when a trader swaps one token for the other. Again, the sender and the destination may not be the same. Each token may be either sent to the exchange, or received from it.

1 event Sync(uint112 reserve0, uint112 reserve1);Finally, Sync is emitted every time tokens are added or withdrawn, regardless of the reason, to provide the latest reserve information (and therefore the exchange rate).

Setup Functions

These functions are supposed to be called once when the new pair exchange is set up.

1 constructor() public {2 factory = msg.sender;3 }The constructor makes sure we'll keep track of the address of the factory that created the pair. This information is required for initialize and for the factory fee (if one exists)

1 // called once by the factory at time of deployment2 function initialize(address _token0, address _token1) external {3 require(msg.sender == factory, 'UniswapV2: FORBIDDEN'); // sufficient check4 token0 = _token0;5 token1 = _token1;6 }This function allows the factory (and only the factory) to specify the two ERC-20 tokens that this pair will exchange.

Internal Update Functions

_update

1 // update reserves and, on the first call per block, price accumulators2 function _update(uint balance0, uint balance1, uint112 _reserve0, uint112 _reserve1) private {This function is called every time tokens are deposited or withdrawn.

1 require(balance0 <= uint112(-1) && balance1 <= uint112(-1), 'UniswapV2: OVERFLOW');If either balance0 or balance1 (uint256) is higher than uint112(-1) (=2^112-1) (so it overflows & wraps back to 0 when converted to uint112) refuse to continue the _update to prevent overflows. With a normal token that can be subdivided into 10^18 units, this means each exchange is limited to about 5.1*10^15 of each tokens. So far that has not been a problem.

1 uint32 blockTimestamp = uint32(block.timestamp % 2**32);2 uint32 timeElapsed = blockTimestamp - blockTimestampLast; // overflow is desired3 if (timeElapsed > 0 && _reserve0 != 0 && _reserve1 != 0) {If the time elapsed is not zero, it means we are the first exchange transaction on this block. In that case, we need to update the cost accumulators.

1 // * never overflows, and + overflow is desired2 price0CumulativeLast += uint(UQ112x112.encode(_reserve1).uqdiv(_reserve0)) * timeElapsed;3 price1CumulativeLast += uint(UQ112x112.encode(_reserve0).uqdiv(_reserve1)) * timeElapsed;4 }Each cost accumulator is updated with the latest cost (reserve of the other token/reserve of this token) times the elapsed time in seconds. To get an average price, you read the cumulative price in two points in time and divide by the time difference between them. For example, assume this sequence of events:

| Event | reserve0 | reserve1 | timestamp | Marginal exchange rate (reserve1 / reserve0) | price0CumulativeLast |

|---|---|---|---|---|---|

| Initial setup | 1,000.000 | 1,000.000 | 5,000 | 1.000 | 0 |

| Trader A deposits 50 token0 and gets 47.619 token1 back | 1,050.000 | 952.381 | 5,020 | 0.907 | 20 |

| Trader B deposits 10 token0 and gets 8.984 token1 back | 1,060.000 | 943.396 | 5,030 | 0.890 | 20+10*0.907 = 29.07 |

| Trader C deposits 40 token0 and gets 34.305 token1 back | 1,100.000 | 909.090 | 5,100 | 0.826 | 29.07+70*0.890 = 91.37 |

| Trader D deposits 100 token1 and gets 109.01 token0 back | 990.990 | 1,009.090 | 5,110 | 1.018 | 91.37+10*0.826 = 99.63 |

| Trader E deposits 10 token0 and gets 10.079 token1 back | 1,000.990 | 999.010 | 5,150 | 0.998 | 99.63+40*1.1018 = 143.702 |

Let's say we want to calculate the average price of Token0 between the timestamps 5,030 and 5,150. The difference in the value of price0Cumulative is 143.702-29.07=114.632. This is the average across two minutes (120 seconds). So the average price is 114.632/120 = 0.955.

This price calculation is the reason we need to know the old reserve sizes.

1 reserve0 = uint112(balance0);2 reserve1 = uint112(balance1);3 blockTimestampLast = blockTimestamp;4 emit Sync(reserve0, reserve1);5 }Finally, update the global variables and emit a Sync event.

_mintFee

1 // if fee is on, mint liquidity equivalent to 1/6th of the growth in sqrt(k)2 function _mintFee(uint112 _reserve0, uint112 _reserve1) private returns (bool feeOn) {In Uniswap 2.0 traders pay a 0.30% fee to use the market. Most of that fee (0.25% of the trade) always goes to the liquidity providers. The remaining 0.05% can go either to the liquidity providers or to an address specified by the factory as a protocol fee, which pays Uniswap for their development effort.

To reduce calculations (and therefore gas costs), this fee is only calculated when liquidity is added or removed from the pool, rather than at each transaction.

1 address feeTo = IUniswapV2Factory(factory).feeTo();2 feeOn = feeTo != address(0);Read the fee destination of the factory. If it is zero then there is no protocol fee and no need to calculate it that fee.

1 uint _kLast = kLast; // gas savingsThe kLast state variable is located in storage, so it will have a value between different calls to the contract.

Access to storage is a lot more expensive than access to the volatile memory that is released when the function call to the contract ends, so we use an internal variable to save on gas.

1 if (feeOn) {2 if (_kLast != 0) {The liquidity providers get their cut simply by the appreciation of their liquidity tokens. But the protocol fee requires new liquidity tokens to be minted and provided to the feeTo address.

1 uint rootK = Math.sqrt(uint(_reserve0).mul(_reserve1));2 uint rootKLast = Math.sqrt(_kLast);3 if (rootK > rootKLast) {If there is new liquidity on which to collect a protocol fee. You can see the square root function later in this article

1 uint numerator = totalSupply.mul(rootK.sub(rootKLast));2 uint denominator = rootK.mul(5).add(rootKLast);3 uint liquidity = numerator / denominator;This complicated calculation of fees is explained in the whitepaper on page 5. We know that between the time kLast was calculated and the present no liquidity was added or removed (because we run this calculation every time liquidity is added or removed, before it actually changes), so any change in reserve0 * reserve1 has to come from transaction fees (without them we'd keep reserve0 * reserve1 constant).

1 if (liquidity > 0) _mint(feeTo, liquidity);2 }3 }Use the UniswapV2ERC20._mint function to actually create the additional liquidity tokens and assign them to feeTo.

1 } else if (_kLast != 0) {2 kLast = 0;3 }4 }If there is no fee set kLast to zero (if it isn't that already). When this contract was written there was a gas refund feature that encouraged contracts to reduce the overall size of the Ethereum state by zeroing out storage they did not need.

This code gets that refund when possible.

Externally Accessible Functions

Note that while any transaction or contract can call these functions, they are designed to be called from the periphery contract. If you call them directly you won't be able to cheat the pair exchange, but you might lose value through a mistake.

mint

1 // this low-level function should be called from a contract which performs important safety checks2 function mint(address to) external lock returns (uint liquidity) {This function is called when a liquidity provider adds liquidity to the pool. It mints additional liquidity tokens as a reward. It should be called from a periphery contract that calls it after adding the liquidity in the same transaction (so nobody else would be able to submit a transaction that claims the new liquidity before the legitimate owner).

1 (uint112 _reserve0, uint112 _reserve1,) = getReserves(); // gas savingsThis is the way to read the results of a Solidity function that returns multiple values. We discard the last returned values, the block timestamp, because we don't need it.

1 uint balance0 = IERC20(token0).balanceOf(address(this));2 uint balance1 = IERC20(token1).balanceOf(address(this));3 uint amount0 = balance0.sub(_reserve0);4 uint amount1 = balance1.sub(_reserve1);Get the current balances and see how much was added of each token type.

1 bool feeOn = _mintFee(_reserve0, _reserve1);Calculate the protocol fees to collect, if any, and mint liquidity tokens accordingly. Because the parameters to _mintFee are the old reserve values, the fee is calculated accurately based only on pool changes due to fees.

1 uint _totalSupply = totalSupply; // gas savings, must be defined here since totalSupply can update in _mintFee2 if (_totalSupply == 0) {3 liquidity = Math.sqrt(amount0.mul(amount1)).sub(MINIMUM_LIQUIDITY);4 _mint(address(0), MINIMUM_LIQUIDITY); // permanently lock the first MINIMUM_LIQUIDITY tokensIf this is the first deposit, create MINIMUM_LIQUIDITY tokens and send them to address zero to lock them. They can never be redeemed, which means the pool will never be emptied completely (this saves us from division by zero in some places). The value of MINIMUM_LIQUIDITY is a thousand, which considering most ERC-20 are subdivided into units of 10^-18'th of a token, as ETH is divided into wei, is 10^-15 to the value of a single token. Not a high cost.

In the time of the first deposit we don't know the relative value of the two tokens, so we just multiply the amounts and take a square root, assuming that the deposit provides us with equal value in both tokens.

We can trust this because it is in the depositor's interest to provide equal value, to avoid losing value to arbitrage. Let's say that the value of the two tokens is identical, but our depositor deposited four times as many of Token1 as of Token0. A trader can use the fact the pair exchange thinks that Token0 is more valuable to extract value out of it.

| Event | reserve0 | reserve1 | reserve0 * reserve1 | Value of the pool (reserve0 + reserve1) |

|---|---|---|---|---|

| Initial setup | 8 | 32 | 256 | 40 |

| Trader deposits 8 Token0 tokens, gets back 16 Token1 | 16 | 16 | 256 | 32 |

As you can see, the trader earned an extra 8 tokens, which come from a reduction in the value of the pool, hurting the depositor that owns it.

1 } else {2 liquidity = Math.min(amount0.mul(_totalSupply) / _reserve0, amount1.mul(_totalSupply) / _reserve1);With every subsequent deposit we already know the exchange rate between the two assets, and we expect liquidity providers to provide equal value in both. If they don't, we give them liquidity tokens based on the lesser value they provided as a punishment.

Whether it is the initial deposit or a subsequent one, the number of liquidity tokens we provide is equal to the square root of the change in reserve0*reserve1 and the value of the liquidity token doesn't change (unless we get a deposit that doesn't have equal values of both types, in which case the "fine" gets distributed). Here is another example with two tokens that have the same value, with three good deposits and one bad one (deposit of only one token type, so it doesn't produce any liquidity tokens).

| Event | reserve0 | reserve1 | reserve0 * reserve1 | Pool value (reserve0 + reserve1) | Liquidity tokens minted for this deposit | Total liquidity tokens | value of each liquidity token |

|---|---|---|---|---|---|---|---|

| Initial setup | 8.000 | 8.000 | 64 | 16.000 | 8 | 8 | 2.000 |

| Deposit four of each type | 12.000 | 12.000 | 144 | 24.000 | 4 | 12 | 2.000 |

| Deposit two of each type | 14.000 | 14.000 | 196 | 28.000 | 2 | 14 | 2.000 |

| Unequal value deposit | 18.000 | 14.000 | 252 | 32.000 | 0 | 14 | ~2.286 |

| After arbitrage | ~15.874 | ~15.874 | 252 | ~31.748 | 0 | 14 | ~2.267 |

1 }2 require(liquidity > 0, 'UniswapV2: INSUFFICIENT_LIQUIDITY_MINTED');3 _mint(to, liquidity);Use the UniswapV2ERC20._mint function to actually create the additional liquidity tokens and give them to the correct account.

12 _update(balance0, balance1, _reserve0, _reserve1);3 if (feeOn) kLast = uint(reserve0).mul(reserve1); // reserve0 and reserve1 are up-to-date4 emit Mint(msg.sender, amount0, amount1);5 }Update the state variables (reserve0, reserve1, and if needed kLast) and emit the appropriate event.

burn

1 // this low-level function should be called from a contract which performs important safety checks2 function burn(address to) external lock returns (uint amount0, uint amount1) {This function is called when liquidity is withdrawn and the appropriate liquidity tokens need to be burned. It should also be called from a periphery account.

1 (uint112 _reserve0, uint112 _reserve1,) = getReserves(); // gas savings2 address _token0 = token0; // gas savings3 address _token1 = token1; // gas savings4 uint balance0 = IERC20(_token0).balanceOf(address(this));5 uint balance1 = IERC20(_token1).balanceOf(address(this));6 uint liquidity = balanceOf[address(this)];The periphery contract transferred the liquidity to be burned to this contract before the call. That way we know how much liquidity to burn, and we can make sure that it gets burned.

1 bool feeOn = _mintFee(_reserve0, _reserve1);2 uint _totalSupply = totalSupply; // gas savings, must be defined here since totalSupply can update in _mintFee3 amount0 = liquidity.mul(balance0) / _totalSupply; // using balances ensures pro-rata distribution4 amount1 = liquidity.mul(balance1) / _totalSupply; // using balances ensures pro-rata distribution5 require(amount0 > 0 && amount1 > 0, 'UniswapV2: INSUFFICIENT_LIQUIDITY_BURNED');The liquidity provider receives equal value of both tokens. This way we don't change the exchange rate.

1 _burn(address(this), liquidity);2 _safeTransfer(_token0, to, amount0);3 _safeTransfer(_token1, to, amount1);4 balance0 = IERC20(_token0).balanceOf(address(this));5 balance1 = IERC20(_token1).balanceOf(address(this));67 _update(balance0, balance1, _reserve0, _reserve1);8 if (feeOn) kLast = uint(reserve0).mul(reserve1); // reserve0 and reserve1 are up-to-date9 emit Burn(msg.sender, amount0, amount1, to);10 }11Prikaži vseThe rest of the burn function is the mirror image of the mint function above.

swap

1 // this low-level function should be called from a contract which performs important safety checks2 function swap(uint amount0Out, uint amount1Out, address to, bytes calldata data) external lock {This function is also supposed to be called from a periphery contract.

1 require(amount0Out > 0 || amount1Out > 0, 'UniswapV2: INSUFFICIENT_OUTPUT_AMOUNT');2 (uint112 _reserve0, uint112 _reserve1,) = getReserves(); // gas savings3 require(amount0Out < _reserve0 && amount1Out < _reserve1, 'UniswapV2: INSUFFICIENT_LIQUIDITY');45 uint balance0;6 uint balance1;7 { // scope for _token{0,1}, avoids stack too deep errorsLocal variables can be stored either in memory or, if there aren't too many of them, directly on the stack. If we can limit the number so we'll use the stack we use less gas. For more details see the yellow paper, the formal Ethereum specifications, p. 26, equation 298.

1 address _token0 = token0;2 address _token1 = token1;3 require(to != _token0 && to != _token1, 'UniswapV2: INVALID_TO');4 if (amount0Out > 0) _safeTransfer(_token0, to, amount0Out); // optimistically transfer tokens5 if (amount1Out > 0) _safeTransfer(_token1, to, amount1Out); // optimistically transfer tokensThis transfer is optimistic, because we transfer before we are sure all the conditions are met. This is OK in Ethereum because if the conditions aren't met later in the call we revert out of it and any changes it created.

1 if (data.length > 0) IUniswapV2Callee(to).uniswapV2Call(msg.sender, amount0Out, amount1Out, data);Inform the receiver about the swap if requested.

1 balance0 = IERC20(_token0).balanceOf(address(this));2 balance1 = IERC20(_token1).balanceOf(address(this));3 }Get the current balances. The periphery contract sends us the tokens before calling us for the swap. This makes it easy for the contract to check that it is not being cheated, a check that has to happen in the core contract (because we can be called by other entities than our periphery contract).

1 uint amount0In = balance0 > _reserve0 - amount0Out ? balance0 - (_reserve0 - amount0Out) : 0;2 uint amount1In = balance1 > _reserve1 - amount1Out ? balance1 - (_reserve1 - amount1Out) : 0;3 require(amount0In > 0 || amount1In > 0, 'UniswapV2: INSUFFICIENT_INPUT_AMOUNT');4 { // scope for reserve{0,1}Adjusted, avoids stack too deep errors5 uint balance0Adjusted = balance0.mul(1000).sub(amount0In.mul(3));6 uint balance1Adjusted = balance1.mul(1000).sub(amount1In.mul(3));7 require(balance0Adjusted.mul(balance1Adjusted) >= uint(_reserve0).mul(_reserve1).mul(1000**2), 'UniswapV2: K');This is a sanity check to make sure we don't lose from the swap. There is no circumstance in which a swap should reduce reserve0*reserve1. This is also where we ensure a fee of 0.3% is being sent on the swap; before sanity checking the value of K, we multiply both balances by 1000 subtracted by the amounts multiplied by 3, this means 0.3% (3/1000 = 0.003 = 0.3%) is being deducted from the balance before comparing its K value with the current reserves K value.

1 }23 _update(balance0, balance1, _reserve0, _reserve1);4 emit Swap(msg.sender, amount0In, amount1In, amount0Out, amount1Out, to);5 }Update reserve0 and reserve1, and if necessary the price accumulators and the timestamp and emit an event.

Sync or Skim

It is possible for the real balances to get out of sync with the reserves that the pair exchange thinks it has.

There is no way to withdraw tokens without the contract's consent, but deposits are a different matter. An account can transfer tokens to the exchange without calling either mint or swap.

In that case there are two solutions:

sync, update the reserves to the current balancesskim, withdraw the extra amount. Note that any account is allowed to callskimbecause we don't know who deposited the tokens. This information is emitted in an event, but events are not accessible from the blockchain.

1 // force balances to match reserves2 function skim(address to) external lock {3 address _token0 = token0; // gas savings4 address _token1 = token1; // gas savings5 _safeTransfer(_token0, to, IERC20(_token0).balanceOf(address(this)).sub(reserve0));6 _safeTransfer(_token1, to, IERC20(_token1).balanceOf(address(this)).sub(reserve1));7 }891011 // force reserves to match balances12 function sync() external lock {13 _update(IERC20(token0).balanceOf(address(this)), IERC20(token1).balanceOf(address(this)), reserve0, reserve1);14 }15}Prikaži vseUniswapV2Factory.sol

This contract creates the pair exchanges.

1pragma solidity =0.5.16;23import './interfaces/IUniswapV2Factory.sol';4import './UniswapV2Pair.sol';56contract UniswapV2Factory is IUniswapV2Factory {7 address public feeTo;8 address public feeToSetter;These state variables are necessary to implement the protocol fee (see the whitepaper, p. 5).

The feeTo address accumulates the liquidity tokens for the protocol fee, and feeToSetter is the address allowed to change feeTo to a different address.

1 mapping(address => mapping(address => address)) public getPair;2 address[] public allPairs;These variables keep track of the pairs, the exchanges between two token types.

The first one, getPair, is a mapping that identifies a pair exchange contract based on the two ERC-20 tokens it exchanges. ERC-20 tokens are identified by the addresses of the contracts that implement them, so the keys and the value are all addresses. To get the address of the pair exchange that lets you convert from tokenA to tokenB, you use getPair[<tokenA address>][<tokenB address>] (or the other way around).

The second variable, allPairs, is an array that includes all the addresses of pair exchanges created by this factory. In Ethereum you cannot iterate over the content of a mapping, or get a list of all the keys, so this variable is the only way to know which exchanges this factory manages.

Note: The reason you cannot iterate over all the keys of a mapping is that contract data storage is expensive, so the less of it we use the better, and the less often we change it the better. You can create mappings that support iteration, but they require extra storage for a list of keys. In most applications you do not need that.

1 event PairCreated(address indexed token0, address indexed token1, address pair, uint);This event is emitted when a new pair exchange is created. It includes the tokens' addresses, the pair exchange's address, and the total number of exchanges managed by the factory.

1 constructor(address _feeToSetter) public {2 feeToSetter = _feeToSetter;3 }The only thing the constructor does is specify the feeToSetter. Factories start without a fee, and only feeSetter can change that.

1 function allPairsLength() external view returns (uint) {2 return allPairs.length;3 }This function returns the number of exchange pairs.

1 function createPair(address tokenA, address tokenB) external returns (address pair) {This is the main function of the factory, to create a pair exchange between two ERC-20 tokens. Note that anybody can call this function. You do not need permission from Uniswap to create a new pair exchange.

1 require(tokenA != tokenB, 'UniswapV2: IDENTICAL_ADDRESSES');2 (address token0, address token1) = tokenA < tokenB ? (tokenA, tokenB) : (tokenB, tokenA);We want the address of the new exchange to be deterministic, so it can be calculated in advance offchain (this can be useful for layer 2 transactions). To do this we need to have a consistent order of the token addresses, regardless of the order in which we have received them, so we sort them here.

1 require(token0 != address(0), 'UniswapV2: ZERO_ADDRESS');2 require(getPair[token0][token1] == address(0), 'UniswapV2: PAIR_EXISTS'); // single check is sufficientLarge liquidity pools are better than small ones, because they have more stable prices. We don't want to have more than a single liquidity pool per pair of tokens. If there is already an exchange, there's no need to create another one for the same pair.

1 bytes memory bytecode = type(UniswapV2Pair).creationCode;To create a new contract we need the code that creates it (both the constructor function and code that writes to memory the EVM bytecode of the actual contract). Normally in Solidity we just use addr = new <name of contract>(<constructor parameters>) and the compiler takes care of everything for us, but to have a deterministic contract address we need to use the CREATE2 opcode.

When this code was written that opcode was not yet supported by Solidity, so it was necessary to manually get the code. This is no longer an issue, because Solidity now supports CREATE2.

1 bytes32 salt = keccak256(abi.encodePacked(token0, token1));2 assembly {3 pair := create2(0, add(bytecode, 32), mload(bytecode), salt)4 }When an opcode is not supported by Solidity yet we can call it using inline assembly.

1 IUniswapV2Pair(pair).initialize(token0, token1);Call the initialize function to tell the new exchange what two tokens it exchanges.

1 getPair[token0][token1] = pair;2 getPair[token1][token0] = pair; // populate mapping in the reverse direction3 allPairs.push(pair);4 emit PairCreated(token0, token1, pair, allPairs.length);5 }Save the new pair information in the state variables and emit an event to inform the world of the new pair exchange.

1 function setFeeTo(address _feeTo) external {2 require(msg.sender == feeToSetter, 'UniswapV2: FORBIDDEN');3 feeTo = _feeTo;4 }56 function setFeeToSetter(address _feeToSetter) external {7 require(msg.sender == feeToSetter, 'UniswapV2: FORBIDDEN');8 feeToSetter = _feeToSetter;9 }10}Prikaži vseThese two functions allow feeSetter to control the fee recipient (if any), and to change feeSetter to a new address.

UniswapV2ERC20.sol

This contract implements the ERC-20 liquidity token. It is similar to the OpenZeppelin ERC-20 contract, so I will only explain the part that is different, the permit functionality.

Transactions on Ethereum cost ether (ETH), which is equivalent to real money. If you have ERC-20 tokens but not ETH, you can't send transactions, so you can't do anything with them. One solution to avoid this problem is meta-transactions. The owner of the tokens signs a transaction that allows somebody else to withdraw tokens offchain and sends it using the Internet to the recipient. The recipient, which does have ETH, then submits the permit on behalf of the owner.

1 bytes32 public DOMAIN_SEPARATOR;2 // keccak256("Permit(address owner,address spender,uint256 value,uint256 nonce,uint256 deadline)");3 bytes32 public constant PERMIT_TYPEHASH = 0x6e71edae12b1b97f4d1f60370fef10105fa2faae0126114a169c64845d6126c9;This hash is the identifier for the transaction type. The only one we support here is Permit with these parameters.

1 mapping(address => uint) public nonces;It is not feasible for a recipient to fake a digital signature. However, it is trivial to send the same transaction twice (this is a form of replay attack). To prevent this, we use a nonce. If the nonce of a new Permit is not one more than the last one used, we assume it is invalid.

1 constructor() public {2 uint chainId;3 assembly {4 chainId := chainid5 }This is the code to retrieve the chain identifier. It uses an EVM assembly dialect called Yul. Note that in the current version of Yul you have to use chainid(), not chainid.

1 DOMAIN_SEPARATOR = keccak256(2 abi.encode(3 keccak256('EIP712Domain(string name,string version,uint256 chainId,address verifyingContract)'),4 keccak256(bytes(name)),5 keccak256(bytes('1')),6 chainId,7 address(this)8 )9 );10 }Prikaži vseCalculate the domain separator for EIP-712.

1 function permit(address owner, address spender, uint value, uint deadline, uint8 v, bytes32 r, bytes32 s) external {This is the function that implements the permissions. It receives as parameters the relevant fields, and the three scalar values for the signature (v, r, and s).

1 require(deadline >= block.timestamp, 'UniswapV2: EXPIRED');Don't accept transactions after the deadline.

1 bytes32 digest = keccak256(2 abi.encodePacked(3 '\x19\x01',4 DOMAIN_SEPARATOR,5 keccak256(abi.encode(PERMIT_TYPEHASH, owner, spender, value, nonces[owner]++, deadline))6 )7 );abi.encodePacked(...) is the message we expect to get. We know what the nonce should be, so there is no need for us to get it as a parameter.

The Ethereum signature algorithm expects to get 256 bits to sign, so we use the keccak256 hash function.

1 address recoveredAddress = ecrecover(digest, v, r, s);From the digest and the signature we can get the address that signed it using ecrecover.

1 require(recoveredAddress != address(0) && recoveredAddress == owner, 'UniswapV2: INVALID_SIGNATURE');2 _approve(owner, spender, value);3 }4If everything is OK, treat this as an ERC-20 approve.

The Periphery Contracts

The periphery contracts are the API (application program interface) for Uniswap. They are available for external calls, either from other contracts or decentralized applications. You could call the core contracts directly, but that's more complicated and you might lose value if you make a mistake. The core contracts only contain tests to make sure they aren't cheated, not sanity checks for anybody else. Those are in the periphery so they can be updated as needed.

UniswapV2Router01.sol

This contract has problems, and should no longer be used. Luckily, the periphery contracts are stateless and don't hold any assets, so it is easy to deprecate it and suggest people use the replacement, UniswapV2Router02, instead.

UniswapV2Router02.sol

In most cases you would use Uniswap through this contract. You can see how to use it here.

1pragma solidity =0.6.6;23import '@uniswap/v2-core/contracts/interfaces/IUniswapV2Factory.sol';4import '@uniswap/lib/contracts/libraries/TransferHelper.sol';56import './interfaces/IUniswapV2Router02.sol';7import './libraries/UniswapV2Library.sol';8import './libraries/SafeMath.sol';9import './interfaces/IERC20.sol';10import './interfaces/IWETH.sol';Prikaži vseMost of these we either encountered before, or are fairly obvious. The one exception is IWETH.sol. Uniswap v2 allows exchanges for any pair of ERC-20 tokens, but ether (ETH) itself isn't an ERC-20 token. It predates the standard and is transferred by unique mechanisms. To enable the use of ETH in contracts that apply to ERC-20 tokens people came up with the wrapped ether (WETH) contract. You send this contract ETH, and it mints you an equivalent amount of WETH. Or you can burn WETH, and get ETH back.

1contract UniswapV2Router02 is IUniswapV2Router02 {2 using SafeMath for uint;34 address public immutable override factory;5 address public immutable override WETH;The router needs to know what factory to use, and for transactions that require WETH what WETH contract to use. These values are immutable, meaning they can only be set in the constructor. This gives users the confidence that nobody would be able to change them to point to less honest contracts.

1 modifier ensure(uint deadline) {2 require(deadline >= block.timestamp, 'UniswapV2Router: EXPIRED');3 _;4 }This modifier makes sure that time limited transactions ("do X before time Y if you can") don't happen after their time limit.

1 constructor(address _factory, address _WETH) public {2 factory = _factory;3 WETH = _WETH;4 }The constructor just sets the immutable state variables.

1 receive() external payable {2 assert(msg.sender == WETH); // only accept ETH via fallback from the WETH contract3 }This function is called when we redeem tokens from the WETH contract back into ETH. Only the WETH contract we use is authorized to do that.

Add Liquidity

These functions add tokens to the pair exchange, which increases the liquidity pool.

12 // **** ADD LIQUIDITY ****3 function _addLiquidity(This function is used to calculate the amount of A and B tokens that should be deposited into the pair exchange.

1 address tokenA,2 address tokenB,These are the addresses of the ERC-20 token contracts.

1 uint amountADesired,2 uint amountBDesired,These are the amounts the liquidity provider wants to deposit. They are also the maximum amounts of A and B to be deposited.

1 uint amountAMin,2 uint amountBMinThese are the minimum acceptable amounts to deposit. If the transaction cannot take place with these amounts or more, revert out of it. If you don't want this feature, just specify zero.

Liquidity providers specify a minimum, typically, because they want to limit the transaction to an exchange rate that is close to the current one. If the exchange rate fluctuates too much it might mean news that change the underlying values, and they want to decide manually what to do.

For example, imagine a case where the exchange rate is one to one and the liquidity provider specifies these values:

| Parameter | Value |

|---|---|

| amountADesired | 1000 |

| amountBDesired | 1000 |

| amountAMin | 900 |

| amountBMin | 800 |

As long as the exchange rate stays between 0.9 and 1.25, the transaction takes place. If the exchange rate gets out of that range, the transaction gets cancelled.

The reason for this precaution is that transactions are not immediate, you submit them and eventually a validator is going to include them in a block (unless your gas price is very low, in which case you'll need to submit another transaction with the same nonce and a higher gas price to overwrite it). You cannot control what happens during the interval between submission and inclusion.

1 ) internal virtual returns (uint amountA, uint amountB) {The function returns the amounts the liquidity provider should deposit to have a ratio equal to the current ratio between reserves.

1 // create the pair if it doesn't exist yet2 if (IUniswapV2Factory(factory).getPair(tokenA, tokenB) == address(0)) {3 IUniswapV2Factory(factory).createPair(tokenA, tokenB);4 }If there is no exchange for this token pair yet, create it.

1 (uint reserveA, uint reserveB) = UniswapV2Library.getReserves(factory, tokenA, tokenB);Get the current reserves in the pair.

1 if (reserveA == 0 && reserveB == 0) {2 (amountA, amountB) = (amountADesired, amountBDesired);If the current reserves are empty then this is a new pair exchange. The amounts to be deposited should be exactly the same as those the liquidity provider wants to provide.

1 } else {2 uint amountBOptimal = UniswapV2Library.quote(amountADesired, reserveA, reserveB);If we need to see what amounts will be, we get the optimal amount using this function. We want the same ratio as the current reserves.

1 if (amountBOptimal <= amountBDesired) {2 require(amountBOptimal >= amountBMin, 'UniswapV2Router: INSUFFICIENT_B_AMOUNT');3 (amountA, amountB) = (amountADesired, amountBOptimal);If amountBOptimal is smaller than the amount the liquidity provider wants to deposit it means that token B is more valuable currently than the liquidity depositor thinks, so a smaller amount is required.

1 } else {2 uint amountAOptimal = UniswapV2Library.quote(amountBDesired, reserveB, reserveA);3 assert(amountAOptimal <= amountADesired);4 require(amountAOptimal >= amountAMin, 'UniswapV2Router: INSUFFICIENT_A_AMOUNT');5 (amountA, amountB) = (amountAOptimal, amountBDesired);If the optimal B amount is more than the desired B amount it means B tokens are less valuable currently than the liquidity depositor thinks, so a higher amount is required. However, the desired amount is a maximum, so we cannot do that. Instead we calculate the optimal number of A tokens for the desired amount of B tokens.

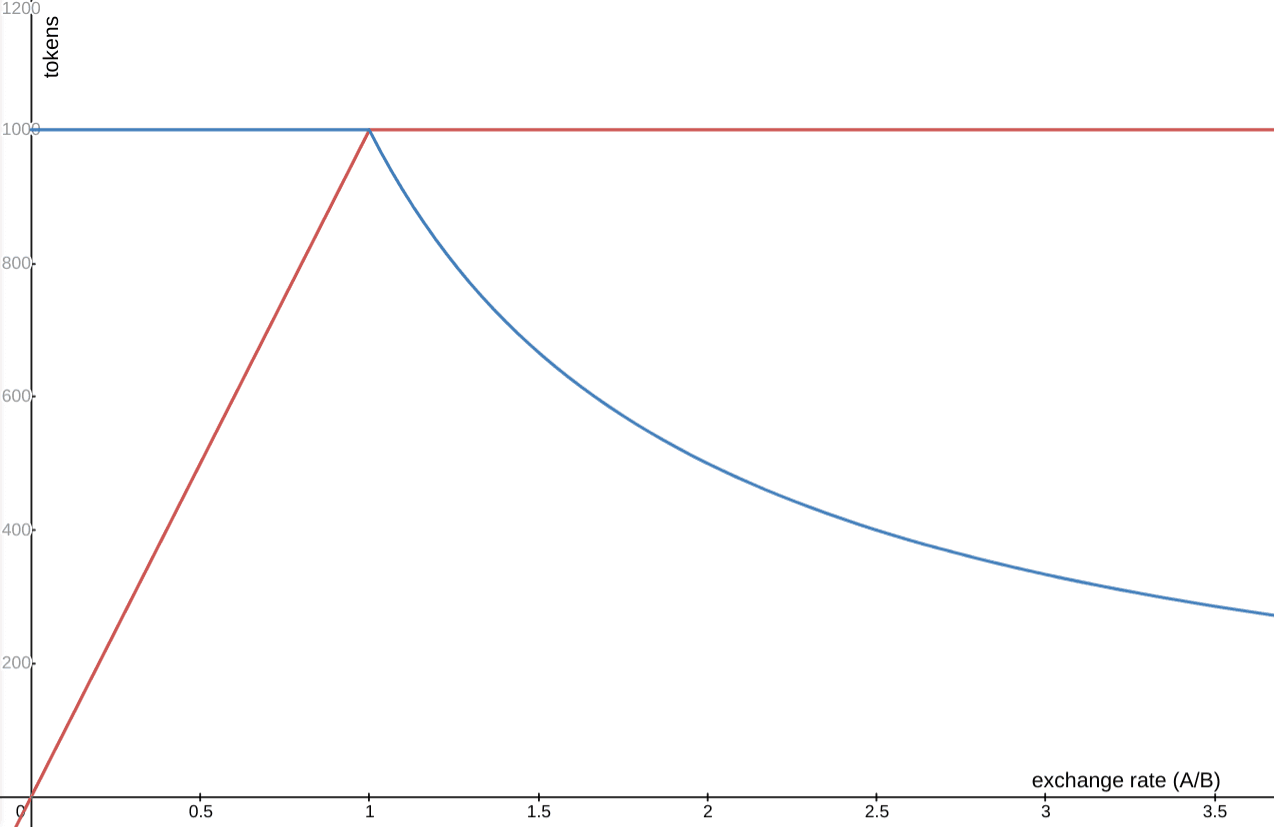

Putting it all together we get this graph. Assume you're trying to deposit a thousand A tokens (blue line) and a thousand B tokens (red line). The x axis is the exchange rate, A/B. If x=1, they are equal in value and you deposit a thousand of each. If x=2, A is twice the value of B (you get two B tokens for each A token) so you deposit a thousand B tokens, but only 500 A tokens. If x=0.5, the situation is reversed, a thousand A tokens and five hundred B tokens.

You could deposit liquidity directly into the core contract (using UniswapV2Pair::mint), but the core contract only checks that it is not getting cheated itself, so you run the risk of losing value if the exchange rate changes between the time you submit your transaction and the time it is executed. If you use the periphery contract, it figures the amount you should deposit and deposits it immediately, so the exchange rate doesn't change and you don't lose anything.

1 function addLiquidity(2 address tokenA,3 address tokenB,4 uint amountADesired,5 uint amountBDesired,6 uint amountAMin,7 uint amountBMin,8 address to,9 uint deadlinePrikaži vseThis function can be called by a transaction to deposit liquidity. Most parameters are the same as in _addLiquidity above, with two exceptions:

. to is the address that gets the new liquidity tokens minted to show the liquidity provider's portion of the pool

. deadline is a time limit on the transaction

1 ) external virtual override ensure(deadline) returns (uint amountA, uint amountB, uint liquidity) {2 (amountA, amountB) = _addLiquidity(tokenA, tokenB, amountADesired, amountBDesired, amountAMin, amountBMin);3 address pair = UniswapV2Library.pairFor(factory, tokenA, tokenB);We calculate the amounts to actually deposit and then find the address of the liquidity pool. To save gas we don't do this by asking the factory, but using the library function pairFor (see below in libraries)

1 TransferHelper.safeTransferFrom(tokenA, msg.sender, pair, amountA);2 TransferHelper.safeTransferFrom(tokenB, msg.sender, pair, amountB);Transfer the correct amounts of tokens from the user into the pair exchange.

1 liquidity = IUniswapV2Pair(pair).mint(to);2 }In return give the to address liquidity tokens for partial ownership of the pool. The mint function of the core contract sees how many extra tokens it has (compared to what it had the last time liquidity changed) and mints liquidity accordingly.

1 function addLiquidityETH(2 address token,3 uint amountTokenDesired,When a liquidity provider wants to provide liquidity to a Token/ETH pair exchange, there are a few differences. The contract handles wrapping the ETH for the liquidity provider. There is no need to specify how many ETH the user wants to deposit, because the user just sends them with the transaction (the amount is available in msg.value).

1 uint amountTokenMin,2 uint amountETHMin,3 address to,4 uint deadline5 ) external virtual override payable ensure(deadline) returns (uint amountToken, uint amountETH, uint liquidity) {6 (amountToken, amountETH) = _addLiquidity(7 token,8 WETH,9 amountTokenDesired,10 msg.value,11 amountTokenMin,12 amountETHMin13 );14 address pair = UniswapV2Library.pairFor(factory, token, WETH);15 TransferHelper.safeTransferFrom(token, msg.sender, pair, amountToken);16 IWETH(WETH).deposit{value: amountETH}();17 assert(IWETH(WETH).transfer(pair, amountETH));Prikaži vseTo deposit the ETH the contract first wraps it into WETH and then transfers the WETH into the pair. Notice that the transfer is wrapped in an assert. This means that if the transfer fails this contract call also fails, and therefore the wrapping doesn't really happen.

1 liquidity = IUniswapV2Pair(pair).mint(to);2 // refund dust eth, if any3 if (msg.value > amountETH) TransferHelper.safeTransferETH(msg.sender, msg.value - amountETH);4 }The user has already sent us the ETH, so if there is any extra left over (because the other token is less valuable than the user thought), we need to issue a refund.

Remove Liquidity

These functions will remove liquidity and pay back the liquidity provider.

1 // **** REMOVE LIQUIDITY ****2 function removeLiquidity(3 address tokenA,4 address tokenB,5 uint liquidity,6 uint amountAMin,7 uint amountBMin,8 address to,9 uint deadline10 ) public virtual override ensure(deadline) returns (uint amountA, uint amountB) {Prikaži vseThe simplest case of removing liquidity. There is a minimum amount of each token the liquidity provider agrees to accept, and it must happen before the deadline.

1 address pair = UniswapV2Library.pairFor(factory, tokenA, tokenB);2 IUniswapV2Pair(pair).transferFrom(msg.sender, pair, liquidity); // send liquidity to pair3 (uint amount0, uint amount1) = IUniswapV2Pair(pair).burn(to);The core contract's burn function handles paying the user back the tokens.

1 (address token0,) = UniswapV2Library.sortTokens(tokenA, tokenB);When a function returns multiple values, but we are only interested in some of them, this is how we only get those values. It is somewhat cheaper in gas terms than reading a value and never using it.

1 (amountA, amountB) = tokenA == token0 ? (amount0, amount1) : (amount1, amount0);Translate the amounts from the way the core contract returns them (lower address token first) to the way the user expects them (corresponding to tokenA and tokenB).

1 require(amountA >= amountAMin, 'UniswapV2Router: INSUFFICIENT_A_AMOUNT');2 require(amountB >= amountBMin, 'UniswapV2Router: INSUFFICIENT_B_AMOUNT');3 }It is OK to do the transfer first and then verify it is legitimate, because if it isn't we'll revert out of all the state changes.

1 function removeLiquidityETH(2 address token,3 uint liquidity,4 uint amountTokenMin,5 uint amountETHMin,6 address to,7 uint deadline8 ) public virtual override ensure(deadline) returns (uint amountToken, uint amountETH) {9 (amountToken, amountETH) = removeLiquidity(10 token,11 WETH,12 liquidity,13 amountTokenMin,14 amountETHMin,15 address(this),16 deadline17 );18 TransferHelper.safeTransfer(token, to, amountToken);19 IWETH(WETH).withdraw(amountETH);20 TransferHelper.safeTransferETH(to, amountETH);21 }Prikaži vseRemove liquidity for ETH is almost the same, except that we receive the WETH tokens and then redeem them for ETH to give back to the liquidity provider.

1 function removeLiquidityWithPermit(2 address tokenA,3 address tokenB,4 uint liquidity,5 uint amountAMin,6 uint amountBMin,7 address to,8 uint deadline,9 bool approveMax, uint8 v, bytes32 r, bytes32 s10 ) external virtual override returns (uint amountA, uint amountB) {11 address pair = UniswapV2Library.pairFor(factory, tokenA, tokenB);12 uint value = approveMax ? uint(-1) : liquidity;13 IUniswapV2Pair(pair).permit(msg.sender, address(this), value, deadline, v, r, s);14 (amountA, amountB) = removeLiquidity(tokenA, tokenB, liquidity, amountAMin, amountBMin, to, deadline);15 }161718 function removeLiquidityETHWithPermit(19 address token,20 uint liquidity,21 uint amountTokenMin,22 uint amountETHMin,23 address to,24 uint deadline,25 bool approveMax, uint8 v, bytes32 r, bytes32 s26 ) external virtual override returns (uint amountToken, uint amountETH) {27 address pair = UniswapV2Library.pairFor(factory, token, WETH);28 uint value = approveMax ? uint(-1) : liquidity;29 IUniswapV2Pair(pair).permit(msg.sender, address(this), value, deadline, v, r, s);30 (amountToken, amountETH) = removeLiquidityETH(token, liquidity, amountTokenMin, amountETHMin, to, deadline);31 }Prikaži vseThese functions relay meta-transactions to allow users without ether to withdraw from the pool, using the permit mechanism.

12 // **** REMOVE LIQUIDITY (supporting fee-on-transfer tokens) ****3 function removeLiquidityETHSupportingFeeOnTransferTokens(4 address token,5 uint liquidity,6 uint amountTokenMin,7 uint amountETHMin,8 address to,9 uint deadline10 ) public virtual override ensure(deadline) returns (uint amountETH) {11 (, amountETH) = removeLiquidity(12 token,13 WETH,14 liquidity,15 amountTokenMin,16 amountETHMin,17 address(this),18 deadline19 );20 TransferHelper.safeTransfer(token, to, IERC20(token).balanceOf(address(this)));21 IWETH(WETH).withdraw(amountETH);22 TransferHelper.safeTransferETH(to, amountETH);23 }24Prikaži vseThis function can be used for tokens that have transfer or storage fees. When a token has such fees we cannot rely on the removeLiquidity function to tell us how much of the token we get back, so we need to withdraw first and then get the balance.

123 function removeLiquidityETHWithPermitSupportingFeeOnTransferTokens(4 address token,5 uint liquidity,6 uint amountTokenMin,7 uint amountETHMin,8 address to,9 uint deadline,10 bool approveMax, uint8 v, bytes32 r, bytes32 s11 ) external virtual override returns (uint amountETH) {12 address pair = UniswapV2Library.pairFor(factory, token, WETH);13 uint value = approveMax ? uint(-1) : liquidity;14 IUniswapV2Pair(pair).permit(msg.sender, address(this), value, deadline, v, r, s);15 amountETH = removeLiquidityETHSupportingFeeOnTransferTokens(16 token, liquidity, amountTokenMin, amountETHMin, to, deadline17 );18 }Prikaži vseThe final function combines storage fees with meta-transactions.

Trade

1 // **** SWAP ****2 // requires the initial amount to have already been sent to the first pair3 function _swap(uint[] memory amounts, address[] memory path, address _to) internal virtual {This function performs internal processing that is required for the functions that are exposed to traders.

1 for (uint i; i < path.length - 1; i++) {As I'm writing this there are 388,160 ERC-20 tokens. If there was a pair exchange for each token pair, it would be over 150 billion pair exchanges. The entire chain, at the moment, only has 0.1% that number of accounts. Instead, the swap functions support the concept of a path. A trader can exchange A for B, B for C, and C for D, so there is no need for a direct A-D pair exchange.

The prices on these markets tend to be synchronized, because when they are out of sync it creates an opportunity for arbitrage. Imagine, for example, three tokens, A, B, and C. There are three pair exchanges, one for each pair.

- The initial situation

- A trader sells 24.695 A tokens and gets 25.305 B tokens.

- The trader sells 24.695 B tokens for 25.305 C tokens, keeping approximately 0.61 B tokens as profit.

- Then the trader sells 24.695 C tokens for 25.305 A tokens, keeping approximately 0.61 C tokens as profit. The trader also has 0.61 extra A tokens (the 25.305 the trader ends up with, minus the original investment of 24.695).

| Step | A-B Exchange | B-C Exchange | A-C Exchange |

|---|---|---|---|

| 1 | A:1000 B:1050 A/B=1.05 | B:1000 C:1050 B/C=1.05 | A:1050 C:1000 C/A=1.05 |

| 2 | A:1024.695 B:1024.695 A/B=1 | B:1000 C:1050 B/C=1.05 | A:1050 C:1000 C/A=1.05 |

| 3 | A:1024.695 B:1024.695 A/B=1 | B:1024.695 C:1024.695 B/C=1 | A:1050 C:1000 C/A=1.05 |

| 4 | A:1024.695 B:1024.695 A/B=1 | B:1024.695 C:1024.695 B/C=1 | A:1024.695 C:1024.695 C/A=1 |

1 (address input, address output) = (path[i], path[i + 1]);2 (address token0,) = UniswapV2Library.sortTokens(input, output);3 uint amountOut = amounts[i + 1];Get the pair we are currently handling, sort it (for use with the pair) and get the expected output amount.

1 (uint amount0Out, uint amount1Out) = input == token0 ? (uint(0), amountOut) : (amountOut, uint(0));Get the expected out amounts, sorted the way the pair exchange expects them to be.

1 address to = i < path.length - 2 ? UniswapV2Library.pairFor(factory, output, path[i + 2]) : _to;Is this the last exchange? If so, send the tokens received for the trade to the destination. If not, send it to the next pair exchange.

12 IUniswapV2Pair(UniswapV2Library.pairFor(factory, input, output)).swap(3 amount0Out, amount1Out, to, new bytes(0)4 );5 }6 }Actually call the pair exchange to swap the tokens. We don't need a callback to be told about the exchange, so we don't send any bytes in that field.

1 function swapExactTokensForTokens(This function is used directly by traders to swap one token for another.

1 uint amountIn,2 uint amountOutMin,3 address[] calldata path,This parameter contains the addresses of the ERC-20 contracts. As explained above, this is an array because you might need to go through several pair exchanges to get from the asset you have to the asset you want.

A function parameter in solidity can be stored either in memory or the calldata. If the function is an entry point to the contract, called directly from a user (using a transaction) or from a different contract, then the parameter's value can be taken directly from the call data. If the function is called internally, as _swap above, then the parameters have to be stored in memory. From the perspective of the called contract calldata is read only.

With scalar types such as uint or address the compiler handles the choice of storage for us, but with arrays, which are longer and more expensive, we specify the type of storage to be used.

1 address to,2 uint deadline3 ) external virtual override ensure(deadline) returns (uint[] memory amounts) {Return values are always returned in memory.

1 amounts = UniswapV2Library.getAmountsOut(factory, amountIn, path);2 require(amounts[amounts.length - 1] >= amountOutMin, 'UniswapV2Router: INSUFFICIENT_OUTPUT_AMOUNT');Calculate the amount to be purchased in each swap. If the result is less than the minimum the trader is willing to accept, revert out of the transaction.

1 TransferHelper.safeTransferFrom(2 path[0], msg.sender, UniswapV2Library.pairFor(factory, path[0], path[1]), amounts[0]3 );4 _swap(amounts, path, to);5 }Finally, transfer the initial ERC-20 token to the account for the first pair exchange and call _swap. This is all happening in the same transaction, so the pair exchange knows that any unexpected tokens are part of this transfer.

1 function swapTokensForExactTokens(2 uint amountOut,3 uint amountInMax,4 address[] calldata path,5 address to,6 uint deadline7 ) external virtual override ensure(deadline) returns (uint[] memory amounts) {8 amounts = UniswapV2Library.getAmountsIn(factory, amountOut, path);9 require(amounts[0] <= amountInMax, 'UniswapV2Router: EXCESSIVE_INPUT_AMOUNT');10 TransferHelper.safeTransferFrom(11 path[0], msg.sender, UniswapV2Library.pairFor(factory, path[0], path[1]), amounts[0]12 );13 _swap(amounts, path, to);14 }Prikaži vseThe previous function, swapTokensForTokens, allows a trader to specify an exact number of input tokens he is willing to give and the minimum number of output tokens he is willing to receive in return. This function does the reverse swap, it lets a trader specify the number of output tokens he wants, and the maximum number of input tokens he is willing to pay for them.

In both cases, the trader has to give this periphery contract first an allowance to allow it to transfer them.

1 function swapExactETHForTokens(uint amountOutMin, address[] calldata path, address to, uint deadline)2 external3 virtual4 override5 payable6 ensure(deadline)7 returns (uint[] memory amounts)8 {9 require(path[0] == WETH, 'UniswapV2Router: INVALID_PATH');10 amounts = UniswapV2Library.getAmountsOut(factory, msg.value, path);11 require(amounts[amounts.length - 1] >= amountOutMin, 'UniswapV2Router: INSUFFICIENT_OUTPUT_AMOUNT');12 IWETH(WETH).deposit{value: amounts[0]}();13 assert(IWETH(WETH).transfer(UniswapV2Library.pairFor(factory, path[0], path[1]), amounts[0]));14 _swap(amounts, path, to);15 }161718 function swapTokensForExactETH(uint amountOut, uint amountInMax, address[] calldata path, address to, uint deadline)19 external20 virtual21 override22 ensure(deadline)23 returns (uint[] memory amounts)24 {25 require(path[path.length - 1] == WETH, 'UniswapV2Router: INVALID_PATH');26 amounts = UniswapV2Library.getAmountsIn(factory, amountOut, path);27 require(amounts[0] <= amountInMax, 'UniswapV2Router: EXCESSIVE_INPUT_AMOUNT');28 TransferHelper.safeTransferFrom(29 path[0], msg.sender, UniswapV2Library.pairFor(factory, path[0], path[1]), amounts[0]30 );31 _swap(amounts, path, address(this));32 IWETH(WETH).withdraw(amounts[amounts.length - 1]);33 TransferHelper.safeTransferETH(to, amounts[amounts.length - 1]);34 }35363738 function swapExactTokensForETH(uint amountIn, uint amountOutMin, address[] calldata path, address to, uint deadline)39 external40 virtual41 override42 ensure(deadline)43 returns (uint[] memory amounts)44 {45 require(path[path.length - 1] == WETH, 'UniswapV2Router: INVALID_PATH');46 amounts = UniswapV2Library.getAmountsOut(factory, amountIn, path);47 require(amounts[amounts.length - 1] >= amountOutMin, 'UniswapV2Router: INSUFFICIENT_OUTPUT_AMOUNT');48 TransferHelper.safeTransferFrom(49 path[0], msg.sender, UniswapV2Library.pairFor(factory, path[0], path[1]), amounts[0]50 );51 _swap(amounts, path, address(this));52 IWETH(WETH).withdraw(amounts[amounts.length - 1]);53 TransferHelper.safeTransferETH(to, amounts[amounts.length - 1]);54 }555657 function swapETHForExactTokens(uint amountOut, address[] calldata path, address to, uint deadline)58 external59 virtual60 override61 payable62 ensure(deadline)63 returns (uint[] memory amounts)64 {65 require(path[0] == WETH, 'UniswapV2Router: INVALID_PATH');66 amounts = UniswapV2Library.getAmountsIn(factory, amountOut, path);67 require(amounts[0] <= msg.value, 'UniswapV2Router: EXCESSIVE_INPUT_AMOUNT');68 IWETH(WETH).deposit{value: amounts[0]}();69 assert(IWETH(WETH).transfer(UniswapV2Library.pairFor(factory, path[0], path[1]), amounts[0]));70 _swap(amounts, path, to);71 // refund dust eth, if any72 if (msg.value > amounts[0]) TransferHelper.safeTransferETH(msg.sender, msg.value - amounts[0]);73 }Prikaži vseThese four variants all involve trading between ETH and tokens. The only difference is that we either receive ETH from the trader and use it to mint WETH, or we receive WETH from the last exchange in the path and burn it, sending the trader back the resulting ETH.

1 // **** SWAP (supporting fee-on-transfer tokens) ****2 // requires the initial amount to have already been sent to the first pair3 function _swapSupportingFeeOnTransferTokens(address[] memory path, address _to) internal virtual {This is the internal function to swap tokens that have transfer or storage fees to solve (this issue).

1 for (uint i; i < path.length - 1; i++) {2 (address input, address output) = (path[i], path[i + 1]);3 (address token0,) = UniswapV2Library.sortTokens(input, output);4 IUniswapV2Pair pair = IUniswapV2Pair(UniswapV2Library.pairFor(factory, input, output));5 uint amountInput;6 uint amountOutput;7 { // scope to avoid stack too deep errors8 (uint reserve0, uint reserve1,) = pair.getReserves();9 (uint reserveInput, uint reserveOutput) = input == token0 ? (reserve0, reserve1) : (reserve1, reserve0);10 amountInput = IERC20(input).balanceOf(address(pair)).sub(reserveInput);11 amountOutput = UniswapV2Library.getAmountOut(amountInput, reserveInput, reserveOutput);Prikaži vseBecause of the transfer fees we cannot rely on the getAmountsOut function to tell us how much we get out of each transfer (the way we do before calling the original _swap). Instead we have to transfer first and then see how many tokens we got back.

Note: In theory we could just use this function instead of _swap, but in certain cases (for example, if the transfer ends up being reverted because there isn't enough at the end to meet the required minimum) that would end up costing more gas. Transfer fee tokens are pretty rare, so while we need to accommodate them there's no need to all swaps to assume they go through at least one of them.

1 }2 (uint amount0Out, uint amount1Out) = input == token0 ? (uint(0), amountOutput) : (amountOutput, uint(0));3 address to = i < path.length - 2 ? UniswapV2Library.pairFor(factory, output, path[i + 2]) : _to;4 pair.swap(amount0Out, amount1Out, to, new bytes(0));5 }6 }789 function swapExactTokensForTokensSupportingFeeOnTransferTokens(10 uint amountIn,11 uint amountOutMin,12 address[] calldata path,13 address to,14 uint deadline15 ) external virtual override ensure(deadline) {16 TransferHelper.safeTransferFrom(17 path[0], msg.sender, UniswapV2Library.pairFor(factory, path[0], path[1]), amountIn18 );19 uint balanceBefore = IERC20(path[path.length - 1]).balanceOf(to);20 _swapSupportingFeeOnTransferTokens(path, to);21 require(22 IERC20(path[path.length - 1]).balanceOf(to).sub(balanceBefore) >= amountOutMin,23 'UniswapV2Router: INSUFFICIENT_OUTPUT_AMOUNT'24 );25 }262728 function swapExactETHForTokensSupportingFeeOnTransferTokens(29 uint amountOutMin,30 address[] calldata path,31 address to,32 uint deadline33 )34 external35 virtual36 override37 payable38 ensure(deadline)39 {40 require(path[0] == WETH, 'UniswapV2Router: INVALID_PATH');41 uint amountIn = msg.value;42 IWETH(WETH).deposit{value: amountIn}();43 assert(IWETH(WETH).transfer(UniswapV2Library.pairFor(factory, path[0], path[1]), amountIn));44 uint balanceBefore = IERC20(path[path.length - 1]).balanceOf(to);45 _swapSupportingFeeOnTransferTokens(path, to);46 require(47 IERC20(path[path.length - 1]).balanceOf(to).sub(balanceBefore) >= amountOutMin,48 'UniswapV2Router: INSUFFICIENT_OUTPUT_AMOUNT'49 );50 }515253 function swapExactTokensForETHSupportingFeeOnTransferTokens(54 uint amountIn,55 uint amountOutMin,56 address[] calldata path,57 address to,58 uint deadline59 )60 external61 virtual62 override63 ensure(deadline)64 {65 require(path[path.length - 1] == WETH, 'UniswapV2Router: INVALID_PATH');66 TransferHelper.safeTransferFrom(67 path[0], msg.sender, UniswapV2Library.pairFor(factory, path[0], path[1]), amountIn68 );69 _swapSupportingFeeOnTransferTokens(path, address(this));70 uint amountOut = IERC20(WETH).balanceOf(address(this));71 require(amountOut >= amountOutMin, 'UniswapV2Router: INSUFFICIENT_OUTPUT_AMOUNT');72 IWETH(WETH).withdraw(amountOut);73 TransferHelper.safeTransferETH(to, amountOut);74 }Prikaži vseThese are the same variants used for normal tokens, but they call _swapSupportingFeeOnTransferTokens instead.

1 // **** LIBRARY FUNCTIONS ****2 function quote(uint amountA, uint reserveA, uint reserveB) public pure virtual override returns (uint amountB) {3 return UniswapV2Library.quote(amountA, reserveA, reserveB);4 }56 function getAmountOut(uint amountIn, uint reserveIn, uint reserveOut)7 public8 pure9 virtual10 override11 returns (uint amountOut)12 {13 return UniswapV2Library.getAmountOut(amountIn, reserveIn, reserveOut);14 }1516 function getAmountIn(uint amountOut, uint reserveIn, uint reserveOut)17 public18 pure19 virtual20 override21 returns (uint amountIn)22 {23 return UniswapV2Library.getAmountIn(amountOut, reserveIn, reserveOut);24 }2526 function getAmountsOut(uint amountIn, address[] memory path)27 public28 view29 virtual30 override31 returns (uint[] memory amounts)32 {33 return UniswapV2Library.getAmountsOut(factory, amountIn, path);34 }3536 function getAmountsIn(uint amountOut, address[] memory path)37 public38 view39 virtual40 override41 returns (uint[] memory amounts)42 {43 return UniswapV2Library.getAmountsIn(factory, amountOut, path);44 }45}Prikaži vseThese functions are just proxies that call the UniswapV2Library functions.

UniswapV2Migrator.sol

This contract was used to migrate exchanges from the old v1 to v2. Now that they have been migrated, it is no longer relevant.

The Libraries

The SafeMath library is well documented, so there's no need to document it here.

Math

This library contains some math functions that are not normally needed in Solidity code, so they aren't part of the language.

1pragma solidity =0.5.16;23// a library for performing various math operations45library Math {6 function min(uint x, uint y) internal pure returns (uint z) {7 z = x < y ? x : y;8 }910 // babylonian method (https://wikipedia.org/wiki/Methods_of_computing_square_roots#Babylonian_method)11 function sqrt(uint y) internal pure returns (uint z) {12 if (y > 3) {13 z = y;14 uint x = y / 2 + 1;Prikaži vseStart with x as an estimate that is higher than the square root (that is the reason we need to treat 1-3 as special cases).

1 while (x < z) {2 z = x;3 x = (y / x + x) / 2;Get a closer estimate, the average of the previous estimate and the number whose square root we're trying to find divided by the previous estimate. Repeat until the new estimate isn't lower than the existing one. For more details, see here.

1 }2 } else if (y != 0) {3 z = 1;We should never need the square root of zero. The square roots of one, two, and three are roughly one (we use integers, so we ignore the fraction).

1 }2 }3}Fixed Point Fractions (UQ112x112)

This library handles fractions, which are normally not part of Ethereum arithmetic. It does this by encoding the number x as x*2^112. This lets us use the original addition and subtraction opcodes without a change.

1pragma solidity =0.5.16;23// a library for handling binary fixed point numbers (https://wikipedia.org/wiki/Q_(number_format))45// range: [0, 2**112 - 1]6// resolution: 1 / 2**11278library UQ112x112 {9 uint224 constant Q112 = 2**112;Prikaži vseQ112 is the encoding for one.

1 // encode a uint112 as a UQ112x1122 function encode(uint112 y) internal pure returns (uint224 z) {3 z = uint224(y) * Q112; // never overflows4 }Because y is uint112, the most it can be is 2^112-1. That number can still be encoded as a UQ112x112.

1 // divide a UQ112x112 by a uint112, returning a UQ112x1122 function uqdiv(uint224 x, uint112 y) internal pure returns (uint224 z) {3 z = x / uint224(y);4 }5}If we divide two UQ112x112 values, the result is no longer multiplied by 2^112. So instead we take an integer for the denominator. We would have needed to use a similar trick to do multiplication, but we don't need to do multiplication of UQ112x112 values.

UniswapV2Library

This library is used only by the periphery contracts

1pragma solidity >=0.5.0;23import '@uniswap/v2-core/contracts/interfaces/IUniswapV2Pair.sol';45import "./SafeMath.sol";67library UniswapV2Library {8 using SafeMath for uint;910 // returns sorted token addresses, used to handle return values from pairs sorted in this order11 function sortTokens(address tokenA, address tokenB) internal pure returns (address token0, address token1) {12 require(tokenA != tokenB, 'UniswapV2Library: IDENTICAL_ADDRESSES');13 (token0, token1) = tokenA < tokenB ? (tokenA, tokenB) : (tokenB, tokenA);14 require(token0 != address(0), 'UniswapV2Library: ZERO_ADDRESS');15 }Prikaži vseSort the two tokens by address, so we'll be able to get the address of the pair exchange for them. This is necessary because otherwise we'd have two possibilities, one for the parameters A,B and another for the parameters B,A, leading to two exchanges instead of one.

1 // calculates the CREATE2 address for a pair without making any external calls2 function pairFor(address factory, address tokenA, address tokenB) internal pure returns (address pair) {3 (address token0, address token1) = sortTokens(tokenA, tokenB);4 pair = address(uint(keccak256(abi.encodePacked(5 hex'ff',6 factory,7 keccak256(abi.encodePacked(token0, token1)),8 hex'96e8ac4277198ff8b6f785478aa9a39f403cb768dd02cbee326c3e7da348845f' // init code hash9 ))));10 }Prikaži vseThis function calculates the address of the pair exchange for the two tokens. This contract is created using the CREATE2 opcode, so we can calculate the address using the same algorithm if we know the parameters it uses. This is a lot cheaper than asking the factory, and

1 // fetches and sorts the reserves for a pair2 function getReserves(address factory, address tokenA, address tokenB) internal view returns (uint reserveA, uint reserveB) {3 (address token0,) = sortTokens(tokenA, tokenB);4 (uint reserve0, uint reserve1,) = IUniswapV2Pair(pairFor(factory, tokenA, tokenB)).getReserves();5 (reserveA, reserveB) = tokenA == token0 ? (reserve0, reserve1) : (reserve1, reserve0);6 }This function returns the reserves of the two tokens that the pair exchange has. Note that it can receive the tokens in either order, and sorts them for internal use.

1 // given some amount of an asset and pair reserves, returns an equivalent amount of the other asset2 function quote(uint amountA, uint reserveA, uint reserveB) internal pure returns (uint amountB) {3 require(amountA > 0, 'UniswapV2Library: INSUFFICIENT_AMOUNT');4 require(reserveA > 0 && reserveB > 0, 'UniswapV2Library: INSUFFICIENT_LIQUIDITY');5 amountB = amountA.mul(reserveB) / reserveA;6 }This function gives you the amount of token B you'll get in return for token A if there is no fee involved. This calculation takes into account that the transfer changes the exchange rate.

1 // given an input amount of an asset and pair reserves, returns the maximum output amount of the other asset2 function getAmountOut(uint amountIn, uint reserveIn, uint reserveOut) internal pure returns (uint amountOut) {The quote function above works great if there is no fee to use the pair exchange. However, if there is a 0.3% exchange fee the amount you actually get is lower. This function calculates the amount after the exchange fee.

12 require(amountIn > 0, 'UniswapV2Library: INSUFFICIENT_INPUT_AMOUNT');3 require(reserveIn > 0 && reserveOut > 0, 'UniswapV2Library: INSUFFICIENT_LIQUIDITY');4 uint amountInWithFee = amountIn.mul(997);5 uint numerator = amountInWithFee.mul(reserveOut);6 uint denominator = reserveIn.mul(1000).add(amountInWithFee);7 amountOut = numerator / denominator;8 }Solidity does not handle fractions natively, so we can't just multiply the amount out by 0.997. Instead, we multiply the numerator by 997 and the denominator by 1000, achieving the same effect.

1 // given an output amount of an asset and pair reserves, returns a required input amount of the other asset2 function getAmountIn(uint amountOut, uint reserveIn, uint reserveOut) internal pure returns (uint amountIn) {3 require(amountOut > 0, 'UniswapV2Library: INSUFFICIENT_OUTPUT_AMOUNT');4 require(reserveIn > 0 && reserveOut > 0, 'UniswapV2Library: INSUFFICIENT_LIQUIDITY');5 uint numerator = reserveIn.mul(amountOut).mul(1000);6 uint denominator = reserveOut.sub(amountOut).mul(997);7 amountIn = (numerator / denominator).add(1);8 }This function does roughly the same thing, but it gets the output amount and provides the input.

12 // performs chained getAmountOut calculations on any number of pairs3 function getAmountsOut(address factory, uint amountIn, address[] memory path) internal view returns (uint[] memory amounts) {4 require(path.length >= 2, 'UniswapV2Library: INVALID_PATH');5 amounts = new uint[](path.length);6 amounts[0] = amountIn;7 for (uint i; i < path.length - 1; i++) {8 (uint reserveIn, uint reserveOut) = getReserves(factory, path[i], path[i + 1]);9 amounts[i + 1] = getAmountOut(amounts[i], reserveIn, reserveOut);10 }11 }1213 // performs chained getAmountIn calculations on any number of pairs14 function getAmountsIn(address factory, uint amountOut, address[] memory path) internal view returns (uint[] memory amounts) {15 require(path.length >= 2, 'UniswapV2Library: INVALID_PATH');16 amounts = new uint[](path.length);17 amounts[amounts.length - 1] = amountOut;18 for (uint i = path.length - 1; i > 0; i--) {19 (uint reserveIn, uint reserveOut) = getReserves(factory, path[i - 1], path[i]);20 amounts[i - 1] = getAmountIn(amounts[i], reserveIn, reserveOut);21 }22 }23}Prikaži vseThese two functions handle identifying the values when it is necessary to go through several pair exchanges.

Transfer Helper

This library adds success checks around ERC-20 and Ethereum transfers to treat a revert and a false value return the same way.

1// SPDX-License-Identifier: GPL-3.0-or-later23pragma solidity >=0.6.0;45// helper methods for interacting with ERC20 tokens and sending ETH that do not consistently return true/false6library TransferHelper {7 function safeApprove(8 address token,9 address to,10 uint256 value11 ) internal {12 // bytes4(keccak256(bytes('approve(address,uint256)')));13 (bool success, bytes memory data) = token.call(abi.encodeWithSelector(0x095ea7b3, to, value));14Prikaži vseWe can call a different contract in one of two ways:

- Use an interface definition to create a function call

- Use the application binary interface (ABI) "manually" to create the call. This is what the author of the code decided to do it.